Diving Deeper: A Comprehensive Review of Earnest Personal Loans

Feb 06, 2024 By Triston Martin

In the dynamic landscape of personal finance, finding a loan that aligns with your needs can be a crucial decision. Enter Earnest Personal Loans – a financial solution that prides itself on flexibility and customer-centric features. Whether you're navigating debt consolidation, embarking on home improvements, or facing unexpected expenses, Earnest aims to provide a versatile and accessible borrowing experience.

Features of Earnest Personal Loans:

Earnest Personal Loans stand out for their flexibility. Whether it's debt consolidation, home improvement, or unexpected expenses, they've got you covered. With loan amounts ranging from $5,000 to $75,000, and APRs that won't break the bank, Earnest caters to a wide audience. Here are some of the exclusive features of Earnest Personal Loans:

Flexible Loan Amounts:

Cover a range of expenses, big or small. Earnest Personal Loans cater to a spectrum of financial needs, whether they're significant expenses or smaller, unexpected costs. The flexibility in loan amounts, ranging from $5,000 to $75,000, ensures that you can address various aspects of your financial life without being constrained by rigid borrowing limits.

Competitive APRs:

One of the standout advantages of Earnest is its commitment to providing borrowers with competitive Annual Percentage Rates (APRs). These rates translate into reasonable interest charges, making your repayments more affordable over the life of the loan. This affordability factor contributes significantly to the overall value of choosing Earnest for your personal financing needs.

Customizable Terms:

Recognizing that one size doesn't fit all, Earnest allows borrowers to customize their loan terms. Whether you prefer a shorter repayment period to minimize interest or a longer term for lower monthly payments, the ability to choose a term that suits your financial situation enhances the adaptability of Earnest Personal Loans.

No Fees for Origination or Prepayment:

In a consumer-friendly move, Earnest eliminates origination and prepayment fees from the equation. This means that when you initiate the loan, you won't face additional charges, and if you decide to pay off your loan ahead of schedule, you won't encounter any penalties. This fee-free approach aligns with Earnest's commitment to helping you keep more money in your pocket throughout the borrowing process.

Pros and Cons of Earnest Personal Loans:

When considering Earnest Personal Loans, it's essential to weigh the advantages and disadvantages to make an informed decision about your financial choices.

Pros:

Low APRs: One of the standout features of Earnest Personal Loans is the low Annual Percentage Rates (APRs). This translates to competitive interest rates, making your repayments more manageable and easing the overall financial burden.

No Fees: Earnest takes a customer-friendly approach by eliminating origination and prepayment fees. This means you won't incur additional costs when initiating the loan or settling it ahead of schedule, ultimately saving you money.

Flexible Repayment Terms: Personal financial situations vary, and Earnest recognizes this. The option to tailor your loan term allows you to find a repayment schedule that aligns with your budget and timeline. This flexibility contributes to a more personalized and stress-free borrowing experience.

Quick Approval: Time is often of the essence when seeking a personal loan, especially for urgent needs. Earnest understands this urgency and provides a swift approval process. The quick decision turnaround ensures that you can address your financial requirements promptly.

Cons:

Strict Approval Criteria: While Earnest offers competitive rates, the qualification requirements might be a bit stringent. Achieving approval may be more challenging if you don't meet their specific criteria, particularly regarding credit score and financial stability.

No Joint Applications: Unlike some lenders who allow co-applicants, Earnest doesn't permit joint applications. This means you can't apply for a loan with a partner or co-borrower, potentially limiting your options if you were considering a shared financial responsibility.

This comprehensive assessment of pros and cons ensures that you choose a loan that not only meets your immediate requirements but also sets you up for a positive financial experience in the long run.

How to Qualify for Earnest Personal Loans?

Eager to get approved? Here's what you need to qualify for Earnest Personal Loans.

Good Credit Score: To boost your chances of approval, aim for a credit score above 680. A solid credit history reflects your creditworthiness.

Stable Income: Earnest wants to ensure you can handle repayments. Demonstrate a consistent income to showcase your financial stability.

Financial Responsibility: Showcase responsible financial behavior. Timely bill payments and a track record of managing credit responsibly can work in your favor.

Debt-to-Income Ratio: While not explicitly stated, a healthy debt-to-income ratio strengthens your application. Lowering existing debts or increasing your income can positively impact this ratio.

How to Apply for Earnest Personal Loans?

Ready to take the plunge? Applying for an Earnest Personal Loan is a straightforward process.

Check Your Eligibility: Use Earnest's online tool to assess if you meet the basic criteria. It's a quick and easy way to determine your initial eligibility.

Complete the Application: Once you confirm eligibility, proceed to the application. Provide necessary details, including personal information and financial specifics. Accuracy here is crucial.

Get Your Rate: Upon approval, Earnest provides you with a personalized interest rate. This rate is based on your creditworthiness and financial profile. Take your time to review the offer.

Review and Accept: Carefully examine the terms and conditions associated with the loan offer. Ensure you understand the interest rate, repayment terms, and any other pertinent details. If everything aligns with your expectations, accept the offer.

Receive Funds: Once you've accepted the offer, Earnest swiftly processes the loan, and the funds are directly deposited into your account. This quick turnaround makes it convenient for addressing your financial needs promptly.

Conclusion:

Earnest Personal Loans offer a viable solution for various financial needs. With competitive rates, flexible terms, and a hassle-free application process, they stand as a reliable option in the personal loan landscape. Consider the pros and cons, ensure you meet the criteria, and if it fits your financial goals, taking that step toward an Earnest Personal Loan might just be the right move for you.

-

Investment Mar 14, 2024

Investment Mar 14, 20243 Ways To Get Into Real Estate Investing

Want to get into real estate? This guide explores buying, renting, and more to jumpstart your wealth-building journey!

-

Investment Feb 03, 2024

Investment Feb 03, 2024Why Have Sovereign Debts Rarely Defaulted Unilaterally in Recent Years?

This article mainly introduces four types of default, namely debt rescheduling, debt restructuring, suspension of debt repayment, and refusal to pay debts.

-

Investment Oct 14, 2023

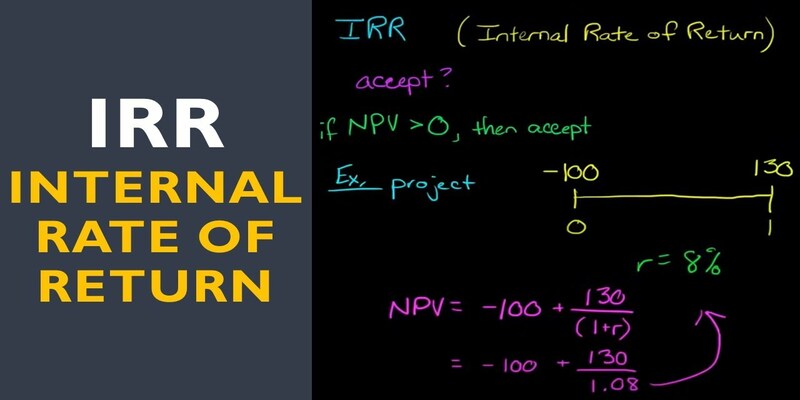

Investment Oct 14, 2023How to use Excel to figure out the internal rate of return

Invest Profitability may be evaluated using the required rate of return, which is the predicted rate of increase for returns stated as a percentage. The zero-net-present-value result of an investment's internal rates of return allows for a direct comparison of the returns generated by various assets over time. The flaws in using the average rate of return arise from counting on the same rate of return for all subsequent investments. When comparing funds with differing rates estimated for the original investment and, indeed, the investment costs of maintenance, a modified rate of return is applicable. Capital budgeting throughout corporate finance relies heavily on the internal rate of return (IRR). It is used by businesses to ascertain the discount rate that would result in a current value after cash flows equivalent to the original capital investment cost.

-

Investment May 13, 2024

Investment May 13, 2024The Ultimate Guide to Retirement Options: IUL, IRAs, vs. 401(k)s

Exploring Indexed Universal Life (IUL), IRAs, and 401(k)s to determine the ideal retirement solution for your needs.