The Ultimate Guide to Retirement Options: IUL, IRAs, vs. 401(k)s

May 13, 2024 By Triston Martin

When it comes to planning for the future, there are a few key players in the game: Indexed Universal Life (IUL) insurance policies, Individual Retirement Accounts (IRAs), and employer-sponsored 401(k) plans. Each of these options offers its own set of benefits and considerations. In this article, we'll take a closer look at how IUL stacks up against IRAs and 401(k)s, helping you understand which might be the right choice for your financial goals.

Understanding Indexed Universal Life (IUL) and IRAs and 401(k)s

Let's start with IUL. Think of it as a combination of life insurance and investment opportunity. With Indexed Universal Life (IUL), you pay premiums. Some of these premiums go towards insurance coverage, while the rest is invested in an account linked to a stock market index like the S&P 500. This means your cash value has the potential to grow over time, depending on how well the index performs.

Individual Retirement Accounts (IRAs) are personal savings accounts designed specifically for retirement. There are two main types: traditional and Roth. With a traditional IRA, you contribute pre-tax dollars, which can lower your taxable income for the year. With a Roth IRA, you contribute after-tax dollars, but your withdrawals in retirement are tax-free. Both types of IRAs offer a range of investment options, including stocks, bonds, and mutual funds.

A 401(k) is an employer-sponsored retirement plan. You put some of your money from your paycheck into the plan, and your employer might add some money too, matching a part of what you contribute. Like IRAs, 401(k) plans offer tax advantages, with traditional 401(k) contributions being pre-tax and Roth 401(k) contributions being after-tax.

How IUL Policies, IRAs, and 401(k)s Work

When planning for your financial future, understanding how Indexed Universal Life (IUL) policies, IRAs, and 401(k) plans function is crucial. Here's a closer look at each:

Indexed Universal Life (IUL) Policies

With an IUL policy, you pay premiums to the insurance company. These premiums are then divided into two parts. Initially, a fraction of the premium is allocated to cover insurance expenses, safeguarding your beneficiaries with a death benefit in case of your demise. The remaining portion of the premium is allocated to a cash value account, which is invested in an index account, often tied to stock market indexes like the S&P 500. The cash value grows over time based on the performance of the chosen index.

Individual Retirement Accounts (IRAs)

Contributions to IRAs can be made by individuals directly or through rollovers from other retirement accounts like 401(k)s or traditional pensions. Once the money is in the IRA, you have control over how it is invested. IRAs offer a variety of investment options, including stocks, bonds, mutual funds, and other securities. You can choose investments based on your risk tolerance, investment goals, and time horizon.

401(k) Plans

A 401(k) is an employer-sponsored retirement plan. Contributions to a 401(k) are typically made through automatic payroll deductions, with a portion of each paycheck going into the plan. Some employers also offer to match a percentage of your contributions, effectively giving you free money towards your retirement savings. Similar to IRAs, you have control over how your contributions are invested within the 401(k) plan. You can choose from a selection of investment options, such as mutual funds, target-date funds, and sometimes individual stocks or bonds.

Costs of IUL Policies, IRAs and 401(k)s

IUL Policies: The expenses linked with IUL policies may fluctuate based on factors such as age, health status, and insurer fees. You'll pay premiums to keep the policy in force, and there may be additional charges for policy administration and investment management.

IRAs: IRAs generally have lower fees compared to IUL policies, especially if you opt for low-cost investment options like index funds or ETFs. However, some IRAs may charge annual maintenance fees or transaction fees for buying and selling investments.

401(k) plans: Like IRAs, 401(k) plans can offer low-cost investment options, but they may also have administrative fees and expenses associated with managing the plan. These costs can vary depending on the size of the plan and the services provided by the plan administrator.

Which One is Better?

Determining which option is betterIndexed Universal Life (IUL), IRAs, or 401(k)sdepends on your unique financial situation, goals, and preferences. Here are some factors to consider:

Risk Tolerance

IUL policies offer a potential for cash value growth linked to the performance of the stock market index, but they also come with risks, such as market downturns affecting returns. IRAs and 401(k)s carry market risks, too, but they provide a broader array of investment choices, enabling you to customize your portfolio based on your risk tolerance.

Tax Considerations

Traditional IRAs and 401(k)s provide tax-deferred growth, meaning you pay taxes on withdrawals in retirement. Roth IRAs and Roth 401(k)s offer tax-free withdrawals in retirement but require you to pay taxes on contributions upfront. Consider your current and future tax situation when deciding which tax treatment suits you best.

Employer Contributions

If your employer offers a matching contribution for your 401(k), it's often wise to contribute enough to receive the full match, as it's essentially free money. This can make a 401(k) particularly attractive for some individuals.

Flexibility

IRAs typically offer more flexibility in terms of investment choices and withdrawal options compared to 401(k) plans, which may have restrictions and penalties for early withdrawals. IUL policies may offer flexibility in premium payments and death benefit adjustments.

Costs and Fees

IUL policies often come with higher fees compared to IRAs and 401(k)s. It's essential to consider all costs associated with each option, including premiums, administrative fees, investment management fees, and surrender charges.

Conclusion

There's no one-size-fits-all answer to whether Indexed Universal Life (IUL), IRAs, or 401(k)s are better. Your decision should be based on your individual financial goals, risk tolerance, and preferences. Consider factors like risk, tax implications, employer contributions, flexibility, and costs when making your choice. Consulting with a financial advisor can help you navigate these options and create a plan that aligns with your long-term financial objectives. Ultimately, the key is to make an informed decision that sets you on the path toward a secure financial future.

-

Know-how May 16, 2024

Know-how May 16, 2024Unveiling Ancillary Benefits: Beyond the Basics of Employee Perks

Explore the impact of ancillary benefits on workplace culture, employee satisfaction, and retention, highlighting how companies can stand out in the job market.

-

Know-how Sep 19, 2024

Know-how Sep 19, 2024Reviewing Fundrise: A Comprehensive Look at Its Benefits and Features

This article explores the benefits and drawbacks of investing with Fundrise, a platform that offers accessible real estate investment opportunities for individuals.

-

Investment Oct 14, 2023

Investment Oct 14, 2023How to use Excel to figure out the internal rate of return

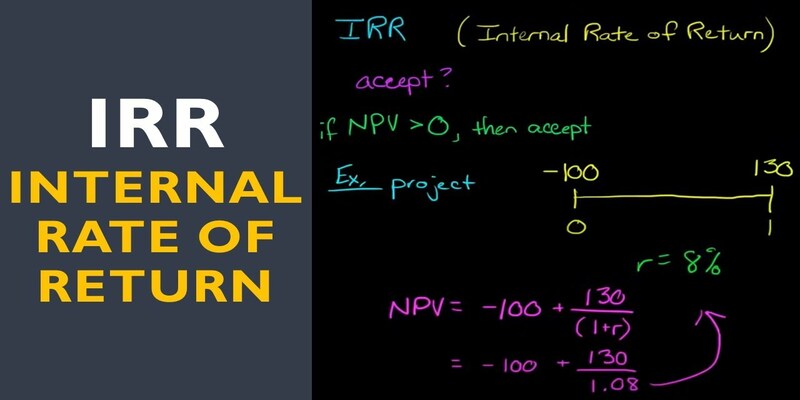

Invest Profitability may be evaluated using the required rate of return, which is the predicted rate of increase for returns stated as a percentage. The zero-net-present-value result of an investment's internal rates of return allows for a direct comparison of the returns generated by various assets over time. The flaws in using the average rate of return arise from counting on the same rate of return for all subsequent investments. When comparing funds with differing rates estimated for the original investment and, indeed, the investment costs of maintenance, a modified rate of return is applicable. Capital budgeting throughout corporate finance relies heavily on the internal rate of return (IRR). It is used by businesses to ascertain the discount rate that would result in a current value after cash flows equivalent to the original capital investment cost.

-

Know-how Dec 23, 2023

Know-how Dec 23, 2023Can you Dissolve a Corporation? Here’s a Step-by-Step Legal Procedure

This step-by-step guide provides the necessary information and resources to ensure a successful cooperation dissolution.