Stock Options vs RSUs: What's the Difference?

Nov 23, 2023 By Triston Martin

Your salary is not the only compensation you may receive when you start a new job. There will likely be benefits, vacation days and stock options. You will most likely receive either RSUs or stock options. Each option has its advantages and disadvantages. You'll need to know which one you are getting so that you can adjust your financial planning accordingly. An advisor can help you navigate your long-term financial plans and employee stock options.

Restricted Stock Units

RSUs are the most popular type of equity compensation. They are usually offered to companies that go public or reach a higher valuation. RSUs are similar to stock options, but they vest over time. However, unlike stock options, you don't need to purchase them. Once fully vested, they no longer have a restricted status and can be bought in the open market like any other shares. RSUs are less risky than stock options. They will still be worth something if the stock price does not drop below $0.

Let's take, for example, a hypothetical situation: Imagine that 10,000 RSUs are granted to you that will vest over four years. The stock price remains at $10 for the entire four-year period (rather than fluctuating normally). The RSUs are worth $100k. Stock options with a strike price of $10 are worthless in this situation unless the stock market goes up.

RSUs vest over many years, much like stock options. Commonly, you will receive 1/4 of your RSUs after your first year and 1/36 each month after that. The value of the shares at the date they vest is subject to ordinary income tax. RSUs, which vest over time, encourage employees to stay longer with the company.

Stock Options

Stock options allow you to purchase or sell shares at a specified price at a future date. Stock options do not require ownership transfer. An employee can profit from the difference between the exercise price and the market price. Startups often offer these incentives to encourage employees to work hard to get their company off the ground.

Market standoff provisions are usually used to restrict stock options. These restrictions prevent the sale of shares after IPO. This is done to stabilize the stock's market price. Stock options offered as compensation by an already public company usually have a vesting period. This allows people to stay with the company for a limited time and not lose stock options that could be valuable.

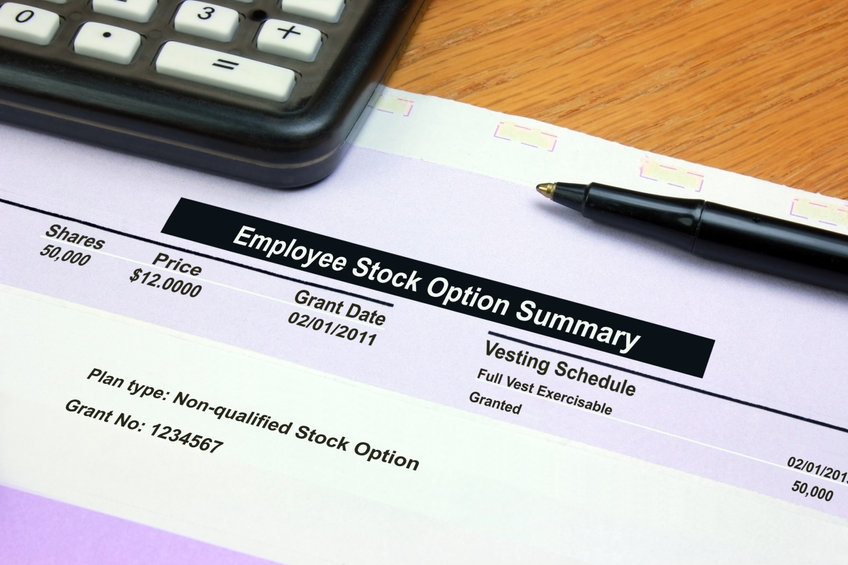

Stock options have many defining characteristics, including transaction date, an exercise price, and the number of shares they cover. One stock option contract equals one hundred shares of the underlying stock. The value of a stock option is determined by the exercise price as well as the current market price of the underlying stock.

Which Is Better?

Stock options and RSUs have their pros and cons. Your personal preferences and a few other factors will influence your choice. The difference between each major category will help you make the right decision. Below is a breakdown of the major differences between stock options and RSUs.

It is important to think about the prospects of the company. Stock options only become valuable if their market value exceeds the grant price at the end of the vesting period. If the stock price is higher than the grant price, then you are paying more for them than you can sell them. RSUs are pure profit since you don't have the money to buy them.

Taxation for Stock Options vs RSUs

It is important to take into account taxes. RSUs are exempt from capital gains taxes. There are two types of stock options: non-qualified stock options, or NSOs, and ISOs. NSOs are subject to tax on the difference in market price and the grant price. This is known as the spread and is subject to regular income tax. Spreading ISOs is not subject to payroll taxes. It's instead a preferred item for AMT. The alternative minimum tax is a parallel tax system that differs from regular tax laws. It can be complex, so it may be worth consulting a financial advisor.

Conclusion

Shares options are granted to employees by their employers, giving them the right to buy a business stock at a discounted price within a certain period. This might occur according to a vesting schedule, which stipulates that a certain number of shares become accessible each year over a certain number of years. On the other hand, restricted stock units (RSUs) are gifts of stock that an employer bestows onto an employee instead of a stock purchase. The benefits might be distributed to workers through shares or a cash equivalent.

-

Know-how Dec 16, 2023

Know-how Dec 16, 2023Who Is A CFP Professional Financial Planner?

The CFP certification requires candidates to demonstrate knowledge of taxation, insurance, estate planning, and retirement planning (including 401(k)s)..

-

Know-how Oct 29, 2023

Know-how Oct 29, 2023Choose a Professional real estate agent

this article has collected useful information on how to choose a listing agent. You can get referrals and reviews from teh friends and relatives. The best way is to choose an agent searching locally.

-

Know-how May 18, 2024

Know-how May 18, 2024Future trading: what it is and how to start

Learn about future trading and everything you need to know to trade futures contracts like a pro!

-

Know-how May 16, 2024

Know-how May 16, 2024Unveiling Ancillary Benefits: Beyond the Basics of Employee Perks

Explore the impact of ancillary benefits on workplace culture, employee satisfaction, and retention, highlighting how companies can stand out in the job market.