All About AmEx Pay It Plan It

Nov 04, 2023 By Triston Martin

American Express introduced a limited beta of a payment planning tool called Pay It Plan It a few years back. Recently, the program's reach was extended to include a more significant number of American Express credit cards in the United States.

We'll explain how Pay It Plan It works and who can benefit from it because American Express's Pay It Plan It program is available on some cardholders' accounts.

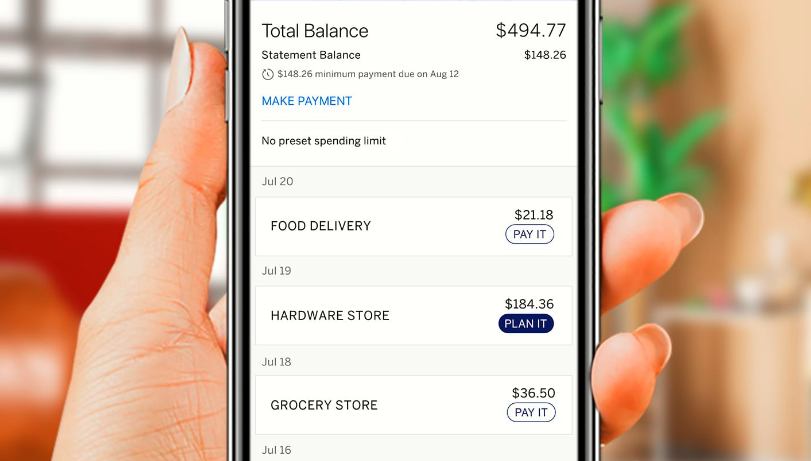

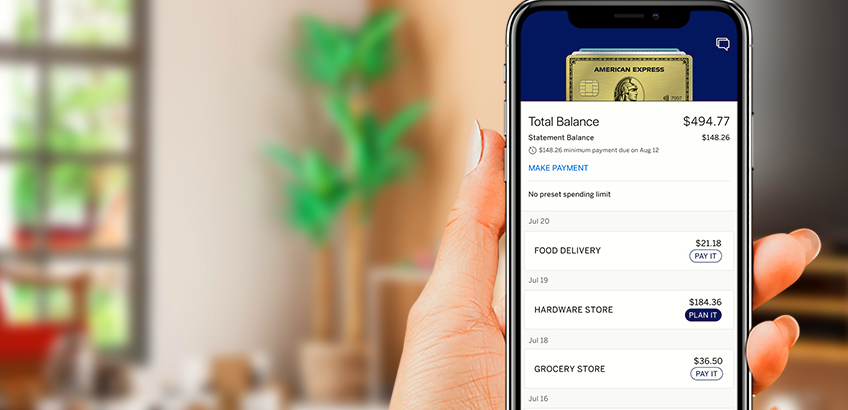

It's Your Turn to Pay Up. Instantly settling purchases under $100 on your credit card is an option. In the American Express app, the option will appear under the dollar amount while seeing the specific charges for your qualifying card.

You can use the Pay It functions by selecting the amount of a qualified purchase you want. Next, make the payment; after 24 to 36 hours, you should see the credit in your account. When using Pay It, you can pay off many charges at once and still be eligible for prizes for early payments.

Truth That Needs to Be Known

It's possible to make smaller payments on your credit card balance monthly using Pay It. When you use Pay It through the app, you can choose individual purchases to pay off, but the money you send is not applied as a credit to any particular transaction. Instead, it will be applied to your minimum monthly balance to reduce your overall debt.

There is no benefit to spreading out your credit card payments throughout the month unless you're utilizing it as a budgeting tool. You'll lose out on interest you could have earned by keeping the money in your bank account and will be sending American Express money before it's needed.

Make a Strategy If you have charges of $100 or more, you can pay them off over time and avoid the interest that would usually be added to your account. When you set up a payment plan, you'll be asked to agree to a monthly plan cost, a fixed finance charge. Checking your app or online account for qualified expenses will allow you to use Plan It.

Start using Plan It by selecting the charge you wish to add to a plan by tapping or clicking on it. Then, you will be allowed to choose between one and three different plan durations. If you click on a different plan, you can learn more about it and see the consistent monthly cost. Choose the Plan you wish to utilize, check out the finer points, and click "Confirm" to finalize the setup. When using Plan It, you can still accumulate points in the same manner as with any other purchase.

After establishing a payment plan, its monthly payment becomes part of the required minimum payment. You should be prepared to pay your total monthly due, including plan payments, each month, as this may increase your minimum monthly payment, especially if you put up many significant charges on plans.

Consequences, Strategies, and Arrangements

You can only have ten plans in effect at once with American Express. There is a significant difference between making a plan using your online account and making a plan through the American Express mobile app. You can bundle up to ten qualified purchases through your online account into a single payment plan. Dreams can only be created with one eligible purchase per Plan in the app.

The problem arises if you want to arrange for any charges to be made at once on your account. You can add up to one hundred payments to your plans using your online account (10 orders for each of the ten goals). The software only allows you to add ten charges to your projects (1 control for each).

Predictive Analyzer for Strategic Planning

The American Express Pre-Purchase Calculator can be used to get a feel for the Plan It features before you commit to using it. After logging into your account and choosing a Plan It-compatible card, the calculator will become available. The calculator can be used regardless of whether or not there are any qualifying purchases on the card.

The Pre-Purchase Calculator provides example plans with 3, 6, and 12-month payoffs once you enter an initial purchase price. The calculator also includes other information, such as the monthly plan charge, total plan fee, and total amount paid, in addition to the minimum monthly payment.

Even though you were required to log in, the calculator does not reflect the plan terms you will be provided. Your Amount Available to Plan and credit limit will still be considered. The Pre-Purchase Calculator is great for learning the ins and outs of the function, but it is of little value for budgeting for future purchases on your particular account.

-

Know-how Oct 27, 2023

Know-how Oct 27, 2023Affordable and Comprehensive Home Protection

House Media's reviewers spent a lot of time researching house insurance providers and settled on seven top picks. Get the Lowest Possible Rates on Homeowners Insurance. Answer the questions below, and we'll take care of the rest.

-

Investment Oct 08, 2023

Investment Oct 08, 2023Everything About the Oil Price Forecast

The term "crude oil" refers to a specific type of petroleum, a liquid fossil fuel derived from underground hydrocarbon reserves and organic elements. This commodity's price tag is quoted in U.S. dollars. Most oil comes from Saudi Arabia, Russia, the United States, Iran, and China. Oil consumption is highest in the United States, China, Japan, and Russia.

-

Investment Feb 04, 2024

Investment Feb 04, 2024Buy Mutual Funds Online

Online is the easiest method to invest directly into Mutual Fund schemes, and you can save commissions too. You can make an online investment through the fund's website, RTA's website, or an online fintech platform. Investing directly on a fund's website requires managing multiple log-ins.

-

Know-how Oct 29, 2023

Know-how Oct 29, 2023Choose a Professional real estate agent

this article has collected useful information on how to choose a listing agent. You can get referrals and reviews from teh friends and relatives. The best way is to choose an agent searching locally.